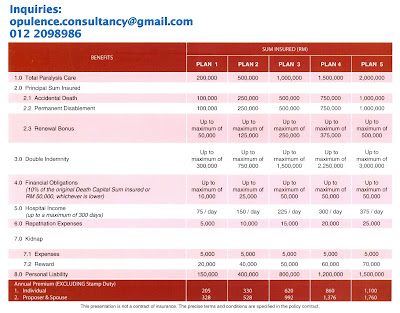

Multi Purpose Insurans Bhd launced their latest product,

=====================================

LUCKY DRAW

2d1n stay at

Swiss-Garden Residences Kuala Lumpur, Malaysia

Worth RM300

Call 012 2098986

email to opulence.consultancy@gmail.com

https://www.facebook.com/events/369172613181064/

======================================

Life can be unpredictable. No one knows when an accident can happen. Serious events can cause major changes in your life or the lives of your love ones. The lifestyle and comfort you and your spouse are enjoying now may be disrupted by an accident. Overnight, things could look very different.

That is why MULTI LUCKY Personal Accident Insurance policy is essential for you to fall back on financially.

=====================================

LUCKY DRAW

2d1n stay at

Swiss-Garden Residences Kuala Lumpur, Malaysia

Worth RM300

Swiss-Garden Residences Kuala Lumpur, Malaysia

Worth RM300

Call 012 2098986 or

email to opulence.consultancy@gmail.com

email to opulence.consultancy@gmail.com

Premium RM500 and above to qualify.

Results will be publish on 31 May 2013

Results will be publish on 31 May 2013